Hearing the term “Share Market” often makes people think it’s complex, risky, or only for the wealthy. While that might have been true 10 years ago, thanks to digital technology, anyone can start investing with as little as ₹100 right from their smartphone.

If you want to grow your savings and participate in the growth of companies, investing in the share market is an excellent way to do it.

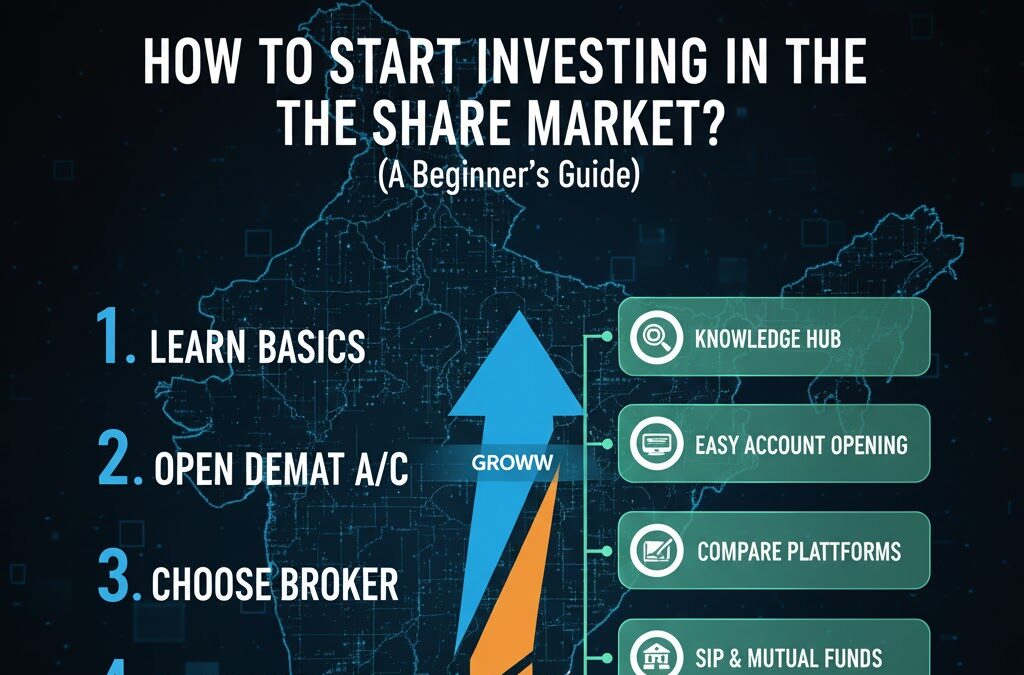

This article is your complete step-by-step guide. We’ll start from “zero” and walk you through the entire process right up to buying your “first share.”

What is the Share Market? (In Simple Terms)

In simple words, the share market is a “marketplace” where you can buy or sell ownership (shares) of listed companies (like Tata Motors, Reliance, HDFC Bank).

When you buy a ‘share’, you become a part-owner of that company. When the company makes a profit and grows, the value of your share also increases.

Section 1: Preparations Before You Start (The Essentials)

Before you download any app, keep these 5 things ready. Your application won’t be approved without them.

- PAN Card: This is mandatory for all financial transactions. You cannot invest without it.

- Aadhaar Card: This is required for your identity and address proof.

- Aadhaar-linked Mobile Number: This is the most critical requirement. Your entire account opening process will be ‘e-Signed’ using an OTP (One-Time Password) sent to the mobile number registered with your Aadhaar.

- Bank Account Proof: You must have an active bank account. For this, you can use a cancelled cheque (with your name printed on it), the front page of your bank passbook, or your latest bank statement.

- Signature: Take a clear photo of your signature on a plain white sheet of paper.

Step 1: Open Your Demat and Trading Account

The first practical step is to open an account with a stockbroker. You need a 2-in-1 account:

- Demat Account: This is like your ‘locker’. When you buy shares, they are held safely here in digital form.

- Trading Account: This is like your ‘marketplace’ or ‘wallet’. You use this account to place orders to buy or sell shares.

Nowadays, all modern brokers (like Zerodha, Groww, Angel One) open this 2-in-1 account for you online, often in less than 15 minutes.

Advice for Beginners: Choose a discount broker (like Zerodha or Groww) that has low fees and an easy-to-use mobile app.

Step 2: Add Funds to Your Trading Account

After your account is approved, you need to add money to it. This is just like adding money to a Paytm or PhonePe wallet.

You can only transfer funds from your linked bank account via UPI, Netbanking, or NEFT.

⚠️ Golden Rule: In the beginning, only invest an amount you can afford to lose (meaning, if you lost it, it wouldn’t seriously impact your life). Starting with ₹1,000 or ₹5,000 is a good idea.

Step 3: How to Buy Your First Share (The Process)

This is the most exciting step. Let’s say you want to buy 1 share of Tata Motors.

- Login: Open your broker’s app (like Kite, Groww) and log in.

- Search: Type “Tata Motors” in the search bar.

- Select: Click on the stock name. You will see two main buttons: BUY and SELL.

- Click BUY: You will now see an order screen. Two things are very important here:

- Quantity (Qty): How many shares do you want to buy? (Example: 1)

- Product Type:

- Delivery (CNC – Cash and Carry): This means you want to buy the share and hold it in your Demat account (for 1 day, 1 year, or 10 years).

- Intraday (MIS): This means you plan to buy and sell the share on the same day before the market closes (3:30 PM).

- Order Type:

- Market: Buy the share immediately at the current market price.

- Limit: You set your own price (e.g., the share is at ₹100, you say “only buy it if it drops to ₹99”).

- ⚠️ Advice for Beginners: Always, always, always select DELIVERY (CNC). Intraday trading is not for beginners. For Order Type, you can start by selecting MARKET for simplicity.

- Place Order: Swipe or click the “Buy” button. Your order is placed!

Step 4: Receiving Your Shares (T+1 Settlement)

After your order is executed, the money will be deducted from your trading account. However, the shares won’t appear in your “holdings” immediately.

India follows a T+1 Settlement rule (Trade + 1 Day). This means the shares you bought today will be delivered to your Demat Account (your ‘locker’) by the next working day.

From the next day, you can see these shares in your “Portfolio” or “Holdings” section. The portfolio is where all your investments are shown, and you can track their profit or loss.

Step 5: Learn, Learn, and Learn

Buying your first share was a 10-minute job. But the real work of becoming a good investor starts now.

What to buy, when to buy, and when to sell—that is the real skill.

- Diversify: Never put all your money into a single company. Invest small amounts in 5-10 good companies across different sectors (e.g., 1 Bank, 1 IT, 1 Auto).

- Learn Fundamental Analysis: What is the company’s business? Is it making a profit? How much debt does it have? This is called ‘Fundamental Analysis’.

- Think Long-Term: The stock market is a marathon, not a sprint. Don’t panic if the price goes up or down daily. Hold good companies for a long time (5-10 years).

Section 2: 5 Biggest Beginner Mistakes (Avoid These)

- Investing on “Tips”: Never trust “hot tips” from SMS, WhatsApp, or Telegram (e.g., “this stock will double in 10 days”). This is 99% a fraud or a scam.

- Chasing Penny Stocks: Don’t run after very cheap stocks (₹1, ₹2). They are cheap for a reason and have the highest risk of going to zero.

- Starting with Intraday/F&O: Beginners should always start with Investing (Delivery), not Trading (Intraday/F&O). Trading is like a high-stress, full-time job and is very high-risk.

- Panic Selling: You bought a good stock, and it fell 10%. Selling it in a panic is one of the biggest mistakes. If the company is good, a price drop can be a good opportunity to buy more.

- Buying with No Research: Don’t buy a stock just because it’s in the news or your friend bought it. Take 5 minutes, Google it, and understand what the company actually does.

Conclusion

Starting in the share market is easier today than ever before. Open your Demat account, start with a small amount of money, buy shares of good companies (in Delivery), and most importantly, keep learning something new every day.

Disclaimer: This article is for educational purposes only. Investing in the share market is subject to market risks. Always do your own research or consult a financial advisor before making any investment.